One Token, Many Possibilities!

Tokenization democratizes real estate investment, creating a more inclusive and dynamic market for investors worldwide.

Digitization of property investment using tokenization

It is a revolutionary process that leverages blockchain technology to transform traditional real estate assets into digital tokens. These tokens represent fractional ownership in the underlying property, allowing investors to buy, sell, and trade portions of real estate assets seamlessly on a secure and decentralized platform. This innovative approach has the potential to disrupt the traditional real estate market and democratize access to lucrative investment opportunities.

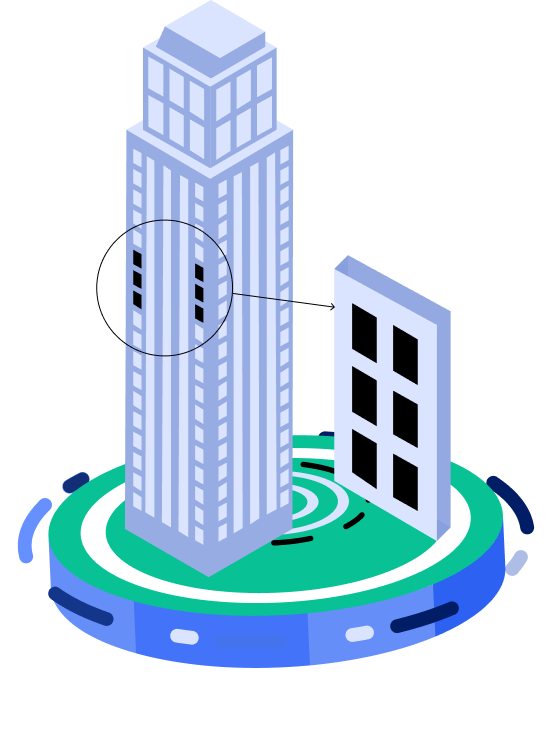

Tokenization Process

Asset selection

The tokenization process begins by selecting a real estate asset that the property owner or developer intends to fractionalize. This can range from residential properties, commercial buildings, shopping centers, or even large-scale development projects.

Legal and regulatory compliance

Before tokenizing the property, the legal framework must be established, adhering to local and international regulations. This ensures that the tokenization process complies with security laws, property ownership regulations, and investor protection requirements.

Asset valuation

An independent valuation of the property is conducted to determine its fair market value. This valuation helps in deciding the number of tokens to be issued and the price of each token.

Smart contract creation

Smart contracts, self-executing agreements with the terms of the investment, are created on the blockchain. These contracts outline the rules and conditions governing the investment, including dividend distribution, ownership rights, and token transferability.

Token issuance

Once the legal and technical aspects are in place, the property is tokenized by issuing digital tokens on a blockchain platform. Each token represents a specific fraction of the property's value, such as 1/1000th or 1/10,000th.

Investor onboarding

Investors interested in the property investment can participate by purchasing these digital tokens. They go through a KYC (Know Your Customer) process to comply with regulatory requirements.